Policygenius Life Insurance Company Review 2026

Reading Policygenius Life Insurance reviews will help you learn more about the life insurance options offered through the company. Some of the major life insurance companies working with Policygenius include AIG, Lincoln Financial, and Pacific Life.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Policygenius is an independent, online insurance broker, not an actual life insurance company

- You can access many of the major life insurance companies through Policygenius

- Policygenius has experienced tremendous growth since its inception in 2014

What is Policygenius? Policygenius may offer a great solution for finding a suitable life insurance policy, which is not always an easy process. You have dozens of insurance carriers to compare and choose from, each with its own selection of policies and unique benefits, and all of them are fighting for your business.

So how can you get help finding the perfect life insurance policy? Fortunately, this is where our Policygenius Life Insurance review comes in.

In a crowded online insurance space, Policygenius is one company that stands out making its presence known. There is even a good chance that you’re reading our Policygenius life insurance review because you recently have come across one of their several YouTube, Instagram, or Facebook ads marketing how they can help find you the best life insurance.

With that said, is Policygenius a good life insurance company?

Policygenius is an independent online insurance broker with a focus on helping consumers shop and compare rates of the insurance products offered online.

Think of Policygenius as a life insurance buyers guide. Visitors can come to its website and receive expert insurance advice, use tools to research insurance options, and even compare rates and apply for policies online.

Choosing a life insurance policy is a major decision. Before trusting the financial security of your loved ones to a website, we would like to help you learn more about Policygenius with our comprehensive review of the insurance company.

As we dig deeper into our Policygenius Life Insurance review, you can also begin comparing life insurance prices. Enter your ZIP code in our free insurance comparison tool to get quotes from multiple insurers.

What is Policygenius Life Insurance and how does it work?

While Policygenius does not directly offer actual life insurance coverage, its job is to help you find the right companies that do. The website works by providing the ability to quickly shop and compare insurance rates from over two dozen of the best life insurance companies.

Since Policygenius is an independent agency, it’s not captive with any single insurance company. Instead, Policygenius is contracted with multiple companies so that they can offer you the best price for your insurance coverage.

Once you’re on the site, you’ll be prompted to provide some basic information. This will vary based on the type of coverage you’re looking for. Once you’ve plugged it in, you’ll be presented with a variety of providers.

If you get stuck or have questions, you will also have access to a massive team of experienced licensed agents on hand ready to help if needed.

This may lead you to ask, how does Policygenius get paid? According to the company, they get a commission from insurance companies for each sale. Policygenius insists that these commissions are already built into the cost of the policy, so consumers are not paying any additional costs.

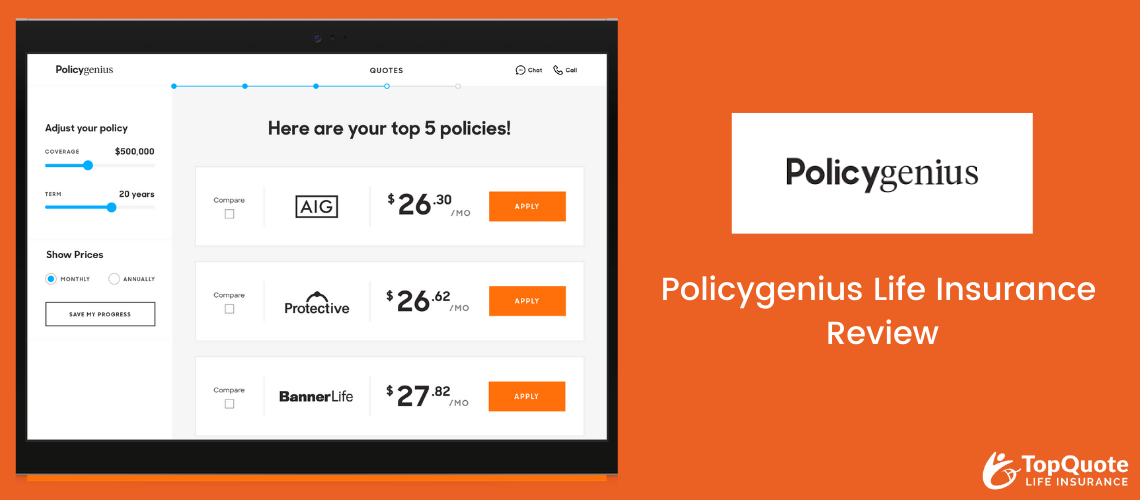

Policygenius Online Quote Process

No matter the type of insurance policy you are seeking, Policygenius has a simple process for comparing and shopping for policies. The website has a responsive design and streamlined layout that works on any device, allowing you to start reviewing options and quotes within 2-3 minutes.

Each online comparison will require some basic information which includes:

- ZIP Code

- Gender

- Date of birth

Depending on the type of coverage, you may also need to answer a few health questions. For example, life insurance, disability insurance, and health insurance options require some basic medical details. You will need to supply your height, weight, tobacco use, and any pre-existing medical conditions.

After entering the required fields, Policygenius presents an instant side-by-side comparison of the top policies in your area. The companies displayed within your quote results will be in order from the lowest price to the highest price.

During the comparison process, you can choose to receive help from a real licensed agent via live chat. If you experience any problems navigating the website or understanding the details of the policies, an agent can walk you through the process.

Along with comparing quotes, the website allows you to apply for a policy online. As we’ve mentioned in this Policygenius Life Insurance review, Policygenius is an independent insurance agency. So when you click on the apply button, they will be able to supply you with an application for any of the companies represented on their website.

You will not need to go through the insurance company directly to obtain a policy.

Policygenius offers many other useful tools on its website. Browse the Policygenius blog section to learn more about the different types of insurance policies and how they work. The informative articles help explain insurance in simple English terms and definitions and not confusing insurance jargon.

How much does Policygenius cost?

As we mentioned earlier, Policygenius is a free service to use. But when it comes to how much you might spend on life insurance procured through the company, that will vary from person to person.

Keep in mind that life insurance costs are dependent upon a variety of personal factors, such as the type of insurance you want, your current health, your family medical history, and the kind of coverage you want.

Keep reading our Policygenius Life Insurance review to learn more.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Policygenius Life Insurance

According to the Insurance Information Institute (III), life insurance can be a “vital part of your family’s financial stability and well-being.” Life insurance is one of the main types of policies offered by Policygenius. The website provides quote comparisons primarily for term life insurance as it is the most affordable and recommend coverage option for most families.

What are some of the forms of life insurance that Policygenius offers?

- Term Life

- Universal Life

- Whole Life

- Variable Life

- Variable Universal Life

- Accelerated Life

Whole life insurance rates can be viewed in addition to the term insurance rates, which can help provide an overall cost difference between the two options.

Keep in mind that whole life insurance can typically cost six to ten times more than a term insurance policy.

To start comparing life insurance quotes, you need to begin by entering your ZIP code. This will make sure that you are only provided with coverage options that are available in your state.

The next step will be basic information such as gender, birth date, citizenship, and if you currently have a spouse or significant other.

After you have answered the basic questions you will need to answer a few standard health questions. Try to answer the health questions as accurately as you can. The quote tool will be able to filter out companies that will not be the best option based on your answer to these questions.

The final step in the life insurance quote process will be choosing a coverage amount and policy length. This step is easily done using a simple click and drag slider button that is used to select a coverage amount that ranges from $50k up to $10 million dollars.

As you slide through the available coverage amounts, rates will begin to appear for all available policy lengths ranging from 10-40 years. You will also be able to view the rate for what a whole life insurance policy will cost as well.

After you have found a policy length and rate that best fits your overall insurance needs, all you will need to do is click the “compare insurers” button. Clicking this button will display all available life insurance companies beginning with the company offering the best price to the company offering the highest price.

While viewing rates you will also be able to view each company’s financial strength rating, customer service rating, the company founded date and the total amount of customers. On the same page, you can also view quotes for a spouse.

Ready to apply? Click the apply button and a licensed Policygenius agent will contact you to walk you through the application process. Policygenius schedules your medical exam (if needed) and handles all the paperwork. During the underwriting process, you can check the progress of your application using the website’s dashboard.

What riders can I add to my Policygenius life insurance policy?

As is the case with any insurance policy, you can add riders to your life insurance through Policygenius. Some include:

- Accelerated Death Benefit

- Return of premium

- Critical illness

- Accidental Death Benefit

- Long term care

…and many more.

Policygenius Life Insurance Calculator

Our next portion of our Policygenius Life Insurance review takes a look at just how much coverage you need. Not sure about how much life insurance you should get? No worries. Policygenius has developed a life insurance calculator that can help customers figure out how much coverage they should apply for.

Within a few minutes and a couple of questions, the Policygenius life insurance calculator will provide both a recommended contract length as well as a suggested amount of coverage. You will also be able to click a quote button that will provide rates for the recommended coverage.

What life insurance companies does Policygenius work with?

Policygenius has contracted with some of the best insurance companies within the life insurance industry. Here are a few that you will consistently see on your life insurance quote results:

- AIG

- Banner Life

- Lincoln Financial

- Mutual of Omaha

- Pacific Life

- Principal

- Protective

- Prudential

- SBLI

- Transamerica

$100 Policygenius Life Insurance Price Promise

Nothing beats affordable life insurance policy rates, and it’s an important part of this Policygenius Life Insurance review. When it comes to saving you money, you could say Policygenius is putting its money where its mouth is. In fact,

Policygenius is confident that you will not find lower term life insurance rates elsewhere that they will back it with their $100 life insurance promise.

It’s the kind of guarantee that makes seeking out the company that much more appealing.

Types of Insurance Policygenius Offers

Next in our Policygenius Life Insurance review? Offerings. Besides helping customers choose affordable life insurance, some of the popular insurance coverage options available through the website include:

- Homeowner’s Insurance

- Renter’s insurance

- Auto insurance

- Disability insurance

- Pet insurance

- Health insurance

Policygenius Homeowner Insurance

For us, our Policygenius Life Insurance review would not be complete without including Policygenius home insurance reviews.

Policygenius uses a different process for comparing homeowners insurance rates. Instead of displaying quotes instantly, the website requires you to fill out a questionnaire about your home.

The questionnaire can take around 3-5 minutes to complete. Once the questionnaire has been completed you will receive an email letting you know that your quote for coverage is being worked by their team of agents.

A Policygenius homeowners quote will take a few days to receive as they will need to reach out to each insurer based on your individual responses on the questionnaire. A licensed agent will work behind the scenes to compare the top carriers to find you the best rates. After comparing your options, your agent will present recommendations on a new policy.

Policygenius can also help find savings within your existing policy. You will need to be sure to upload a copy of the declaration pages of your existing coverage utilizing their PolicyScan service. This option is made available during the initial quoting process and is as simple as uploading a pdf copy or even a photo of the pages.

Policygenius will analyze your current homeowner’s coverage to see if they can do better as well as let you know of any discounts you may be eligible for.

Shopping your homeowner’s coverage with Policygenius can potentially result in annual savings of up to $690 per year.

They will also re-shop your coverage annually to ensure that you’re always receiving the best rates.

Total time to get a quote: 3-5 minutes

Homeowners Insurance Companies Offered With Policygenius

Now that you’ve heard more about the homeowner’s insurance process, you may be wondering: what companies are offered through Policygenius? Here’s your answer:

- Progressive

- Travelers

- MetLife

- Hippo

- AIG

- Stillwater

- Nationwide

- Safeco

Policygenius Renter’s Insurance

Along with homeowners insurance, Policygenius helps compare rates and apply for renters insurance. This type of coverage protects your personal items such as furniture, clothes, electronics, and other personal possessions in your apartment or rental home.

For example, if you were renting an apartment or home and the residence was damaged by a fire, flooded or even burglarized, renters insurance would payout a claim to help replace the damaged or stolen items.

It also helps cover the cost of what it will take to live in temporary housing while your rental is being repaired.

Rental insurance can be valuable insurance that can offer a large amount of protection at an inexpensive cost. Policies typically cost less than $20 per month depending on the number of personal items that need to be protected. Rates for renters coverage is generally based on your location and the amount of protection needed.

With Policygenius, the quote process for renter insurance can be done rather quickly. Rates for coverage will be available immediately with the option to apply for coverage on the spot.

To begin the quote process you will need to fill out basic information about yourself such as name, date of birth and address of current residence. You all need to specify if you are currently renting a home, apartment, townhome or condominium.

The next part of the quoting process involves answering a few different questions that will help determine the type of renters coverage you will be eligible for based on your responses.

If eligible for coverage, you will be directed to select a total amount of renters coverage ranging from $10,000 up to $100,000. You will be able to choose from different deductible amounts as well as adjust benefits involving payouts for personal liability and medical payments that would be paid to others.

Prior to checkout, you will have the option to choose from a few optional add-ons that can be added to overall coverage. After you have completed the quote process you will have the option to purchase your renter insurance plan and have coverage instantly.

Renters Insurance Companies Offered with Policygenius

- Stillwater Insurance Group

Policygenius Auto Insurance

At the moment, if you’re looking for just an auto insurance quote, Policygenius will refer you to one of their many trusted partner sites to help get you rates.

If you’re ok with bundling your quote with your home and auto, Policygenius will be able to handle the quotes in-house. This option can generally save people up to 20% on average when the two coverage options are bundled together.

Auto Insurance Companies Partnered with Policygenius

- Coverhound

- Liberty Mutual

- Allstate

- USAA

- State Farm

Policygenius Disability Insurance

Disability insurance protects your financial security in the event of an illness or disability. When you can no longer work, the insurance replaces a portion of your income so you do not need to dip into your savings or retirement account.

To compare options, the website requires you to enter a bit of information about yourself as well as your occupation.

After providing the requested Policygenius will recommend a monthly benefit amount based on the information that has been provided. The benefit amount can be adjusted prior to moving onto the next step.

The next step is to choose an elimination period. By default, a 90-day elimination period will be selected based on it being the most cost-effective option. However, this can be changed to elimination periods of 60-days, 180-days or 365-days.

After selecting an elimination period you will need to choose a benefit period. The benefit period is the total amount of time payments will be paid out while disabled. Benefit periods range from 2, 5, or 10 years or up to retirement (age 65 or 67).

The final step in the quote process consists of answering a few yes or no questions pertaining to optional add-ons as well as a list of basic health questions. Once you have completed all the steps, you will be presented with an estimated monthly cost range for coverage.

Policygenius will need to reach out to all of the companies they work with to get actual rates. Once they have received all responses, Policygenius will email you the results.

Total time to get a quote: 5 minutes

Disability Insurance Companies Offered With Policygenius

- Assurity

- Guardian

- MassMutual

- Principal

- TheStandard

Policygenius Pet Insurance

Pet insurance can help you save on expensive veterinary costs should your pet become injured or sick. Policygenius works with a few different pet insurance companies to offer plans for both dogs and cats. There are various plans to choose with some having the ability to pay 100% towards vet costs.

To begin comparing plans, you’ll start by entering your pet’s name along with a few other basic details such as type of pet, purebred or mixed breed, and gender.

The next step will require your zip code, the pet’s birthdate, and whether or not your pet has any pre-existing conditions. After providing this information there will be a series of questions pertaining to your pet as well as yourself. These questions will determine if you may be eligible for a 15% discount on your plan.

The final step of the quote process will require you to choose a type of coverage. The two options include accident and illness or accident only. You may also choose if you would like to add additional add-ons such as wellness benefits that can cover the cost of checkups, vaccinations, heartworm medication, and much more.

Once you’re all done selecting your plan options, you will be able to view all plans that are available to you and your pet based on the selected quote criteria. Each plan provides the deductible amount, reimbursement percentage, and an overall benefit amount. Every plan can be viewed in great detail prior to applying.

Total time to get a quote: 4-5 minutes

Pet Insurance Companies Offered With Policygenius

- ASPCA

- Pets Best

- Petplan

Policygenius Health Insurance

Before you can compare health insurance plans, you will need to submit your zip code, county of residence, and email address. Within seconds of providing this information, Policygenius will let you know how many plans and carriers are available in your area.

Remember that when shopping for health insurance it needs to be done during the open enrollment period. There are special circumstances in which this does not apply and if you fall within one of those circumstances, you may apply for coverage.

The health insurance quote process can be a bit longer of a quoting process as there are multiple steps to complete. You will need to select options such as the desired monthly budget and an annual deductible. There will also be a section to check if any current doctors or prescriptions will be covered.

Once you have completed all of the pre-quote information, Policygenius will display all available plans beginning on what you have selected as the most important priorities your health insurance plans should have.

Total time to get a quote: 4-5 minutes

Along with these insurance types, Policygenius includes comparisons for other insurance products:

- Vision insurance

- Long-term care insurance

- Prescription discount cards

- Jewelry insurance

- Identity theft insurance

- Travel insurance

Pros and Cons of Using Policygenius Life Insurance

Most Policygenius life insurance reviews are positive with the majority of customers commenting on how easy the entire comparison and application process was. There is very little to dislike about Policygenius as a company or with the website.

However, not everything is perfect and there are a few minor drawbacks that should be addressed prior to working with the company.

The Pros of Policygenius Life Insurance

From the ease of access to the simple application progress, let’s begin with some of the pros.

Free Information & Tools

The Policygenius website is loaded with tons of helpful and fact-filled information about all types of insurance. You will find several helpful company reviews, as well as useful tools such as the life insurance needs calculator.

Easy-to-Navigate Website

The insurance website is easy to use even for those who are not comfortable with modern technology, such as older individuals. The website has a clean interface without flashy images and unnecessary distractions or advertisements.

Quick Access to Insurance Quotes

Within minutes of answering a few questions, you will receive access to several quotes from the top insurance companies. The estimated monthly premiums are displayed in large fonts, allowing you to quickly scroll and adjust options to find the most affordable policy.

Anonymous Quote Comparison

Unlike some of the other comparison sites, Policygenius allows you to pretty much shop freely and anonymously. The quote questionnaire does not require any contact information in order to receive rates. You only need to supply your full contact information when applying for a policy.

Easy Online Application Process

Ready to apply for coverage? The team at Policygenius handles all the paperwork for you or you can easily complete it on your own online. You will also be provided with a customer login account that will keep you up to date throughout the underwriting process.

The Cons to Using Policygenius Life Insurance

Limited options and costs – here is our list of cons to using Policygenius.

They Don’t Represent All Companies

While Policygenius has many advantages, it also has a few potential limitations. One issue is the selection of insurance companies.

To provide customers with the best policies, the website works with several of the largest insurance companies all with an A.M. Best rating of A or better.

The only drawback to this is that there are plenty of smaller insurance companies out there that can definitely compete on price with some of the larger companies.

Some of these smaller companies can even specialize in certain medical conditions or lifestyle habits that the larger companies will not accept or require a larger premium to insure.

May Not Always Be The Cheapest Option

With the many insurance companies that Policygenius does offer, we can say that there will be a good chance they will or will come very close to being able to offer the cheapest price for coverage.

However, keep in mind that there are literally thousands of insurance companies and Policygenius is not contracted to sell them all. There always will be a chance that there may be a cheaper option available with a little extra research.

Can’t Tell Who Is Offering A No Exam Option

If you’re looking for a no medical exam life insurance option, Policygenius can offer it. The problem is that you will have a difficult time finding out which company it is that is offering the no exam option.

The quote results do not provide a clear indication as to which of the companies require an exam and which do not require an exam. To get this information you will need to ask a representative.

No GUL Option

Policygenius life insurance quotes are primarily based on term life insurance. You can view whole life insurance rates but it’s clear that the company’s main focus is providing affordable term life insurance to their customers.

Term insurance offers many benefits and is easily the most purchased type of life insurance coverage available. Although whole life insurance has a purpose, it’s typically not the ideal insurance option for most people.

However, an issue that we noticed when using the Policygenius quote tool is that there is not an option to view rates for guaranteed universal life insurance, or GUL for short. This is a bit disappointing, as GUL insurance can be an affordable permanent life insurance option.

May Not Be Ideal for Seniors

Seniors need life insurance coverage too! Another life insurance option not available on the Policygenius website is final expense insurance or burial insurance.

Final expense insurance is generally purchased by senior citizens who need just enough life insurance protection to cover funeral costs as well as to cover small debts.

Seniors who require final expense or burial life insurance coverage will not find quotes readily available on the website, unfortunately.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Policygenius Life Insurance Reviews & Ratings

We can’t do a proper Policygenius Life Insurance review without hearing from consumers or ratings-issuing agencies. While Policygenius has only existed for a little over five years, they have helped millions of people shop for insurance coverage resulting in several positive customer reviews. However, if you’re looking for an AM Best, Moody’s, or S&P rating, you will not find one.

These types of ratings only apply to the actual life insurance companies that supply insurance coverage. They are typically represented with a letter grade that provides insight into the insurance company’s current and future financial strengths.

Keep in mind that Policygenius is an insurance agency designed to help you purchase insurance coverage. Rest assured that Policygenius has plenty of positive online reviews.

One review company that can always be relied on is the Better Business Bureau or BBB for short.

Since the launch of the website, Policygenius has been an accredited business with the BBB and has held an A rating along with several positive customer reviews.

Along with an excellent BBB rating, Policygenius has also received a significant amount of positive customer reviews from the popular Trustpilot review site. The insurance agency currently has over 1,000 reviews with a 4.9 out of 5 customer rating and it keeps growing daily.

Policygenius’s Time in Business

Considering Policygenius’ growing footprint, you may be curious about its origins. To be more specific, questions about its origination may come to mind.

Here’s what we know about its beginnings: Two people founded Policygenius in 2014. Their names are Jennifer Fitzgerald and Francois de Lame, and they are former McKinney employees.

In this short amount of time, Policygenius has grown leaps and bounds. In fact, more than $161 million has been raised, including $100 million in January 2020.

Policygenius’s Location

Policygenius’s main headquarters is located in the heart of New York City. The company operates with a staff of over 200 employees along with 5 furry friends that you can find roaming around the office. In 2019 Policygenius announced that they would be opening a second headquarters in Durham, North Carolina. This is a clear indication of how rapidly Policygenius is growing.

Positions with the insurance organization offer an average salary of $72,000 to qualifying applicants. Another bonus to working at Policygenius is that they were ranked the #1 Best Places to Work by Inc.

Legitimacy of Policygenius Life Insurance

This very question is essential to our Policygenius Life Insurance review. Policygenius advertising can be located just about everywhere on the internet from social media to the popular Joe Rogan podcast. Even big names with large followings have endorsed the insurance company to their listeners, such as the Policygenius Ben Shapiro partnership.

But does this make the company legit?

This is a valid question considering the short period of time that the insurance company has been in existence. Rest assured though, Policygenius is a legitimate company. They are licensed to sell insurance products in all 50 U.S. states including Washington D.C.

During the short period of time that Policygenius has been around, the company has been able to help over 30 million people get life insurance coverage alone. This number doesn’t even reflect the total amount of people they have helped get insurance outside of life insurance.

Policygenius is upfront with every detail about insurance options to how the company receives commissions for each policy that it sells. To avoid a conflict of interest, the website offers transparency and an abundance of free resources.

When you compare quotes, the website displays options from all companies that Policygenius has been contracted with. You have the freedom to choose any policy within your quote results. The website does not prioritize the quotes based on commissions or affiliations with insurance companies.

Policygenius also helps educate consumers, which is a common advantage listed in several of the Policygenius Trustpilot reviews. Instead of simply pushing the costliest policy, the website helps explain the advantages and disadvantages of each choice.

The site also has a team of experts to assist with specific questions. Instead of receiving a commission, the company’s experts are salaried employees. They focus on providing valuable advice rather than trying to sell you an expensive policy. They also have a few experienced in-house underwriters to make sure you are applying with the best company based on your unique quote criteria.

Should you use Policygenius life insurance?

Policygenius offers one of the best online shopping experiences when it comes to purchasing insurance. Their technology is a step above what any other online insurance agency is currently offering in our opinion.

If you’re in the market for insurance coverage, we would have no problem recommending Policygenius. Because of this, Top Quote Life Insurance has recently become a trusted partner with Policygenius. Our customers can now experience all of the benefits of Policygenius with the help of Top Quote Life Insurance.

You’ve officially made it to the end of our Policygenius Life Insurance review. Now is the time to take action and begin comparing rates. We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.